These can alter hands to have a portion of the price of old-fashioned futures during these indicator, and enable All of us and you will international buyers to help you exchange a transfer-based package on the S&P five-hundred with shorter money. Outside of the better-known item and you may economic futures, you will find a varied list of futures deals designed for exchange. Interest rate futures, including Treasury securities, allow buyers to deal with rate of interest risk otherwise display an impression on the rate movements.

It means sticking with their change bundle despite brief-label results, controlling risk for each trading, and to avoid impulsive decisions driven by thoughts. Whenever a swap goes better, don’t pursue a lot more earnings recklessly; if this goes badly, don’t look for payback because of the doubling off. Stay focused on the picture as a whole and you can keep in mind that victory inside futures trading try a long game. A switch part of handling futures positions is effective risk government as a result of avoid-loss and you will funds-address orders.

What exactly is a great futures deal?

For each and every tool possesses its own expiration schedule, that is monthly, every quarter, or even weekly.

For example, harsh oils futures on the CME end monthly, when you’re E-small S&P 500 futures features quarterly expirations. This enables people and you may buyers when planning on taking a view on the new direction out of cost over a longer time period by buying/attempting to sell lengthened old deals. With regards to futures change, you need to first become familiar with all the the techniques, as well as purchase costs, control, and debt. It is very essential to squeeze into a trusted broker and you may get to know individuals underlying assets out of futures agreements.

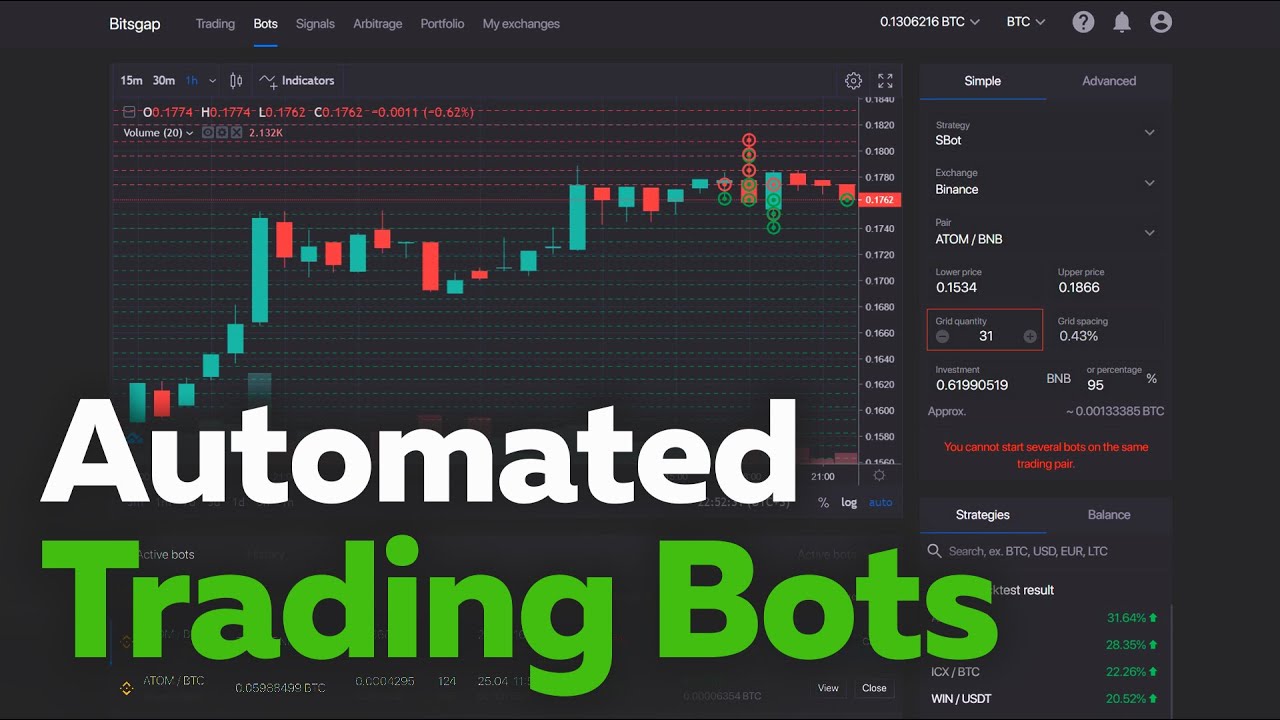

Why does investment an automated Currency Course are employed in my personal futures account?

It would be a good idea to invest two months participating in thus-entitled papers change to test thoroughly your strategy instead of placing currency at stake. They could make use of these types to hedge the risk one a great part of the portfolio have a tendency to belong value. They’re able to attempt by employing a short hedge method, that’s anything a trader can do whenever they believe that the worth of an underlying resource usually slip over time. Precious metals, along with gold, silver, copper, and precious metal, features futures you to definitely trading extensively. This type of agreements can be used by the miners, suppliers, and you will traders to help you hedge facing price volatility.

For many retail traders, physical delivery is not something, while the ranking are usually closed just before expiration. Although not, it’s imperative to know the expiration times and the prospective effect on the change strategy. Because of the very liquid characteristics out of futures places, buyers can certainly move in and you may from their openings. Promoting a good futures deal is apparently much easier than brief-offering carries. Personal buyers or investors are not explore futures agreements to make a great profit, otherwise businesses or hedgers utilize them to help you hedge against rising prices. Whereas private people wear’t should own the new real commodity, institutional buyers try to end speed grows of raw materials they requirement for development.

Just how Futures Agreements Performs

Futures exchange is also a great hedging unit for organizations looking to protect on their own away from bad price moves. Including, a trip might buy spray strength futures so you can protect rates and you will lessen abrupt spikes inside the fuel costs that will impression its realization. By using futures in order to hedge, buyers and you will businesses can aid in reducing their connection with rate risk and manage much more stable efficiency. Very futures buyers today don’t want to in reality take birth from a secured asset – come across much more about expiration schedules below. Since the futures try leveraged, traders don’t have to make the whole collateral total go into the brand new change. It also can make futures trading riskier, while the whilst the first margin is lowest if the trade goes facing you, buyers chance losing additional money than simply they invested.

- Particular investors (speculators) specialize in a couple of futures groups simply because they has an edge and knowledge of those people markets’ fundamentals and you can financial fashion.

- We give an explanation for similarities and differences when considering futures and ETFs within our online way, and CME Category.

- One unforeseen change to the environment or increasing conditions might cause the new futures rate to increase or lose.

- A futures bargain allows the events to shop for or offer a great certain root advantage from the an appartment coming date.

For individuals who offer a binding agreement, you invest in provide the fundamental investment at the given rate. Through to the expiration date, you could potentially intend to liquidate your role otherwise move it give. View this short video to own info on first margin, marking to market, maintenance margin, and moving currency between the broker and you will futures accounts. Now, let’s go ahead and make a trial membership to your Plus500 thus I’m able to make suggestions around. I really like demo accounts in this way while they ensure it is traders to feel futures trading rather than risking real cash. Consumers and you will vendors of these futures agreements see possibilities to have rate develops and you can a means to hedge against risk.

Learn the difference in 1st margin (to open up ranks) and you can repair margin (to keep ranking open). Prior to moving to your futures trade, understanding the equilibrium from options and you will risks is essential. The fresh assortment of products produces this category for example fascinating to own people seeking to diversify past economic segments.

Why don’t we unpack the brand new particulars of futures exchange, the dangers inside, and whether it is the right investment technique for your. Influence allows people to control a great number of the underlying advantage with a somewhat number of financing, called margin. Interest futures is actually monetary types that allow people to take a position for the or hedge up against future changes in rates. These futures tend to be the individuals to have Treasury bills, notes, and securities, and on interest rate benchmarks. Treasury futures ensure it is traders to take a position to the otherwise hedge against alter within the interest rates, which affect the value of Treasury securities. For example, T-note futures are used to hedge up against movement inside the 10-year Treasury mention production, which can be benchmarks to possess financial or any other crucial monetary cost.

Become familiar with the brand new broker’s trading system, and if it is possible to, have fun with a habit membership (papers change) to build confidence rather than risking real money. A forward-manager, however, could possibly get shell out nothing until settlement to the last time, probably increase a huge equilibrium; this may be reflected in the mark by a keen allowance to possess borrowing risk. When the deliverable asset is available within the plentiful likewise have or may be freely created, then your price of a great futures bargain is set thru arbitrage objections. This really is typical to possess stock index futures, treasury bond futures, and you will futures to your real merchandise if they are in the also provide (e.grams. agricultural vegetation following the collect).

- Now, let’s concentrate on the Age-Small Nasdaq Future, with an initial margin requirement of $step three,224.sixty.

- Because of the mix-referencing these types of tech signals which have macroeconomic analysis otherwise market-specific reports, people can develop a properly-informed means.

- Both form of deal are used for speculation, along with hedging.

- It’s such as getting an investigator, exploring clues regarding the earlier to resolve coming market secrets.

- Various other consideration is that when a trader trades numerous futures contracts, it could be problematic for them to screen its respective expiry times.

Futures tend to provide large control and will be much more profitable when predictions try best, however they along with hold large dangers. Alternatives supply the shelter out of a nonbinding deal, limiting prospective losses. For example, a great wheat futures deal you will specify 5,one hundred thousand bushels of a certain stages, deliverable within the December. Buyers don’t typically expect to discover physical grain; alternatively, it close-out ranking before expiration, benefiting from rate moves. Alternatives exchange entails high chance and that is perhaps not right for the customers. Customers need to read and see the Services and you may Dangers of Standardized Alternatives ahead of engaging in people possibilities change steps.

As an example, a trader can get small a petroleum futures package if the per week petroleum stocks develop during the a more quickly speed than simply analysts got questioned. Of course, particular people can get incorporate both technology and you may standard investigation in their futures exchange bundle. Very futures deals is actually replaced thanks to centralized exchanges like the Chicago Board out of Exchange and also the Chicago Mercantile Change (CME). Of numerous cryptocurrency agents, such Binance, offer perpetual futures—a binding agreement rather than a keen expiration time—enabling buyers never to care about a keen expiration day.

Additionally, an investor is choose to have fun with give change anywhere between two correlated segments, as the other requires have a tendency to move around in a similar assistance. Such as, a trader might have to go much time S&P futures and you can small NASDAQ futures when they believe the fresh S&P is actually undervalued beside the NASDAQ. For example, it isn’t an easy task to discover whether or not commodities’ cost, such as corn, rise or down rather than within the-depth field education. It requires an edge and understanding of segments’ fundamentals and you may financial trend, belief, and you may method through tech analysis. Futures contracts need the customer otherwise seller to buy or offer the fresh asset to your a specific arranged upcoming date and you can rates detailed from the agreement. Futures trading always comes to influence and the broker needs a primary margin, a little area of the bargain really worth.